Covered Liabilities / Managed Risk (CLMR) Retirement Funds

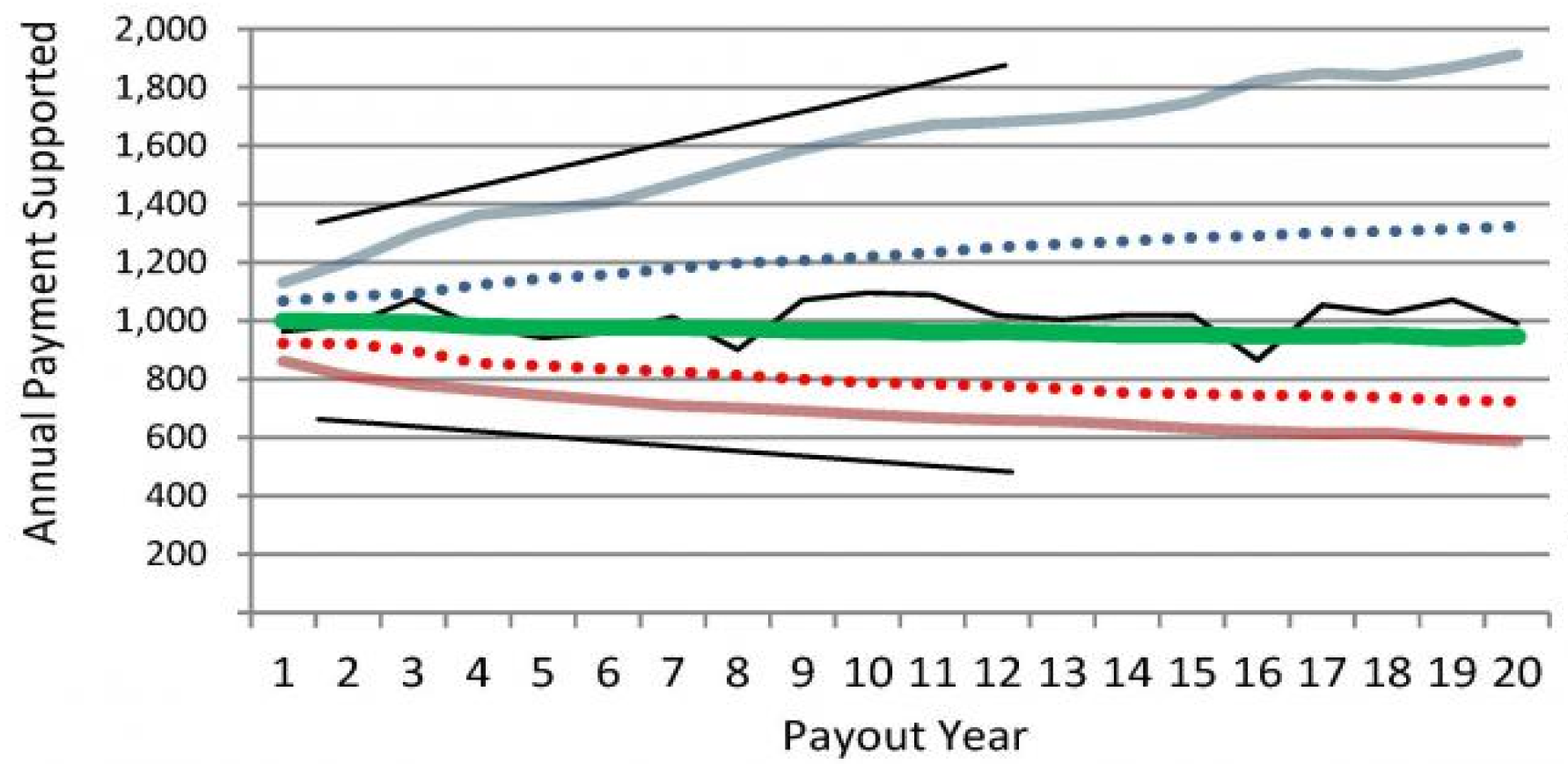

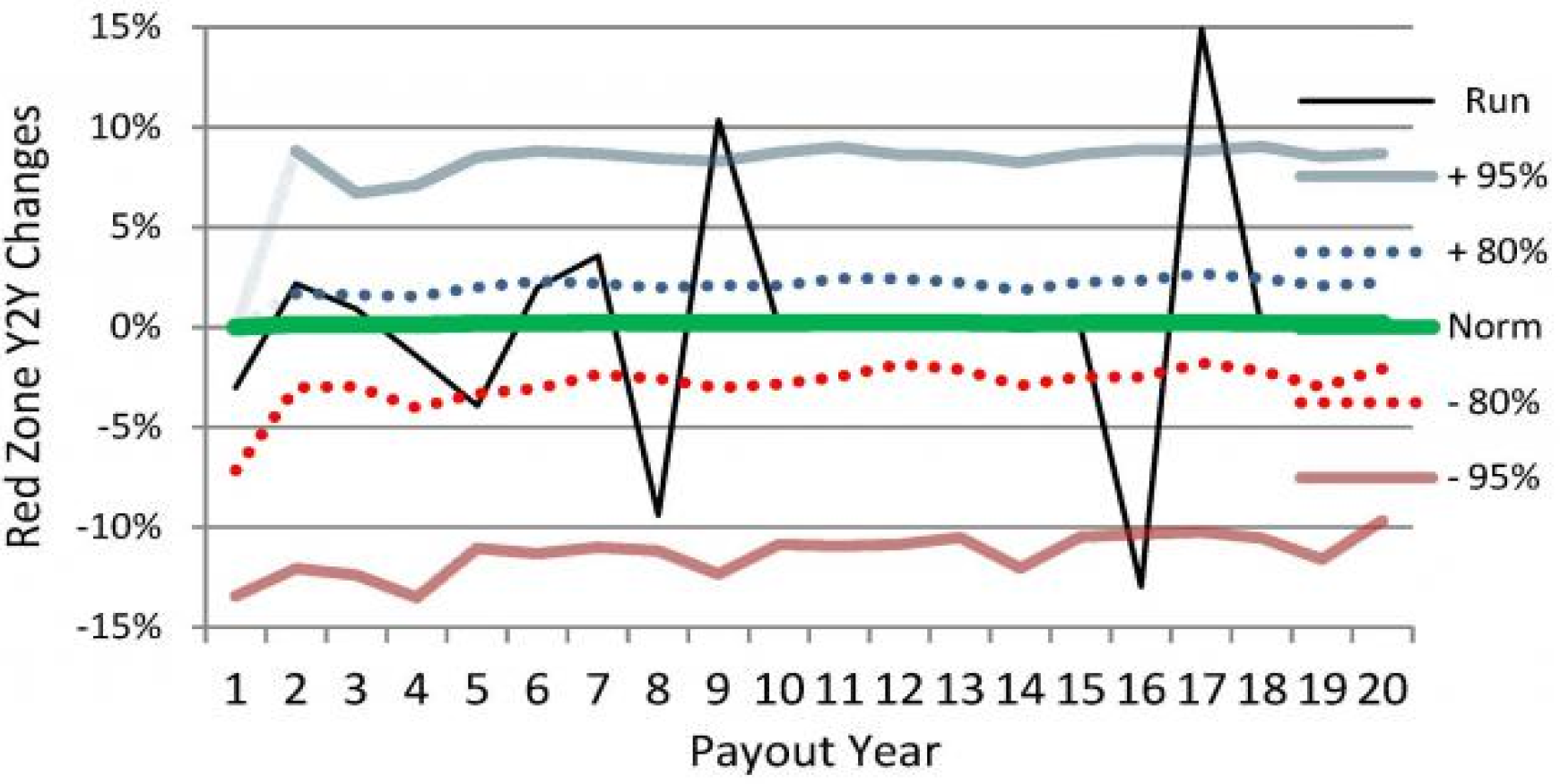

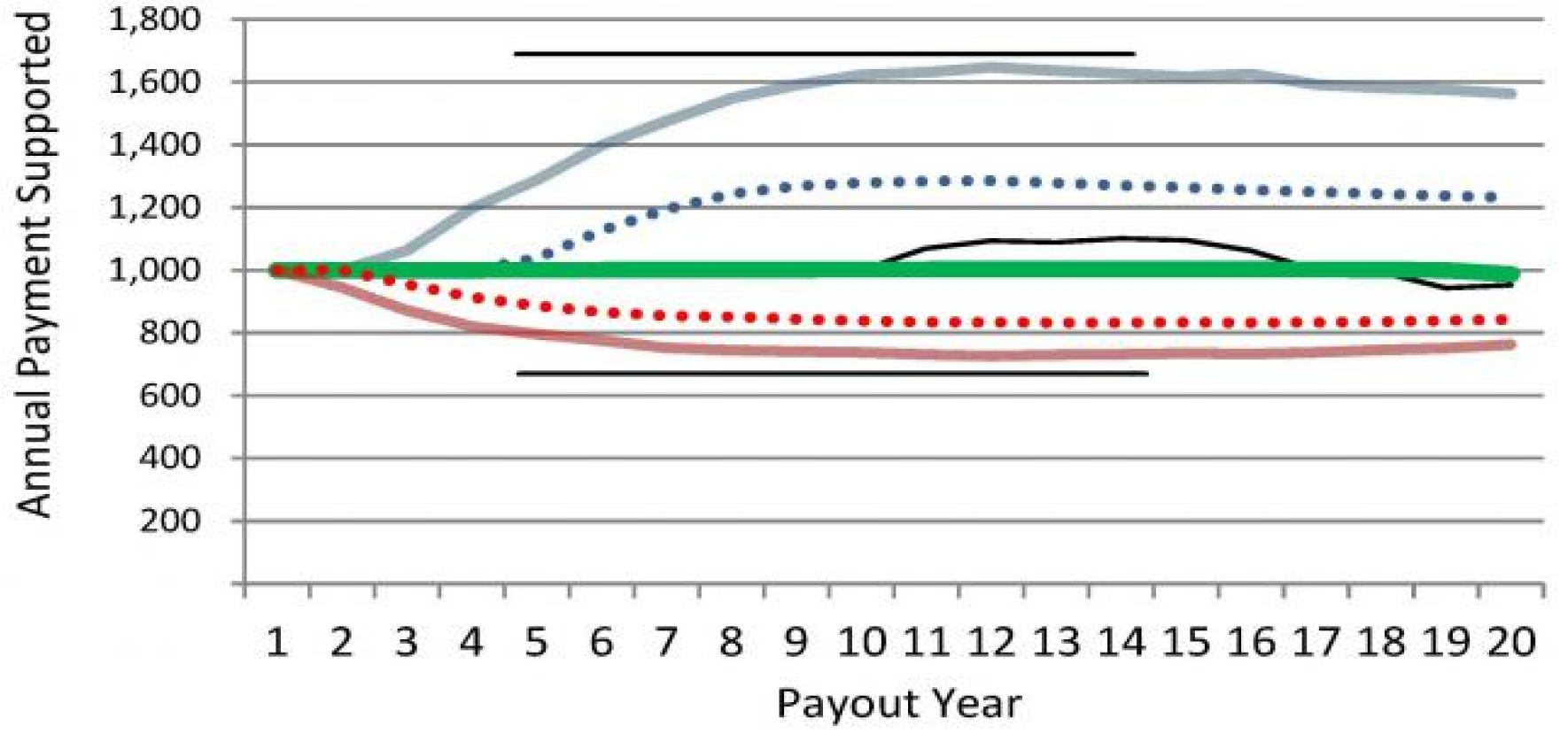

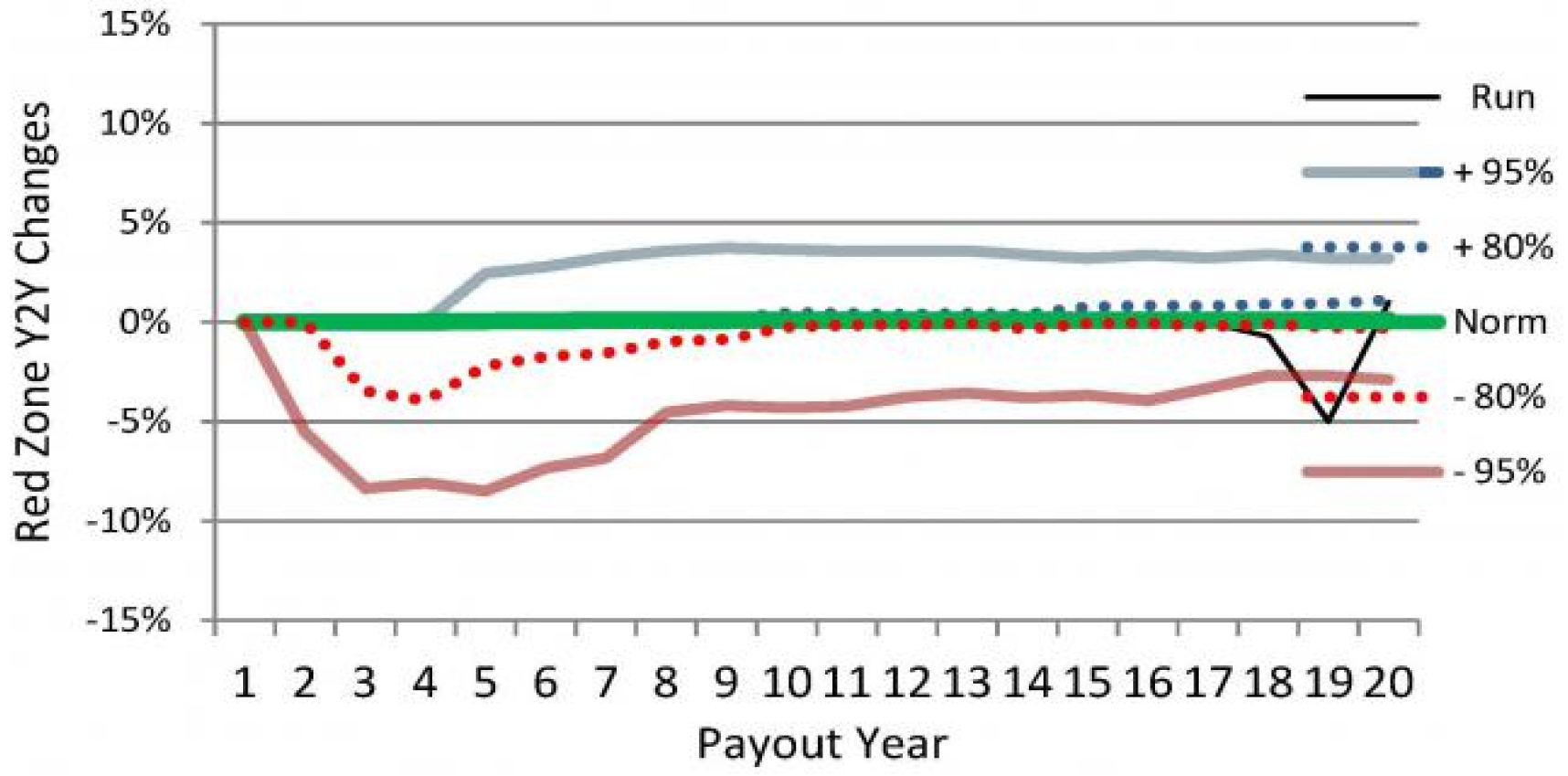

CLMR Funds follow a patended approach to generating stabilized payouts of a person's invested funds over a specific period of time -- often twenty years.

They are a type of Stabilized Payout Fund and are most ideally suited for objectives that many may have between, say, age 65, when semi-retirement might begin, and 85, after which longevity for the continuation of that income for one and their spouse is the primary risk to cover. A combination of an investment in a CLMR, Stabilized Payout Fund and a substantially deferred, single payment life annuity that can pick up after the Stabilized Payout Fund period, is often a good combination that retains the upside from stock investing through the twenty year period covered by the CLMR Fund payouts and then has a smooth transition to a low cost, deferred life annuity to cover continuation of payments after the twenty year CLMR payout period has completed. Costs on the deferred life annuity stay low in the overall mix when it is purchased twenty years in advance, which the CLMR Stabilized Payout Fund enables.

Utilizing a CLMR fund for the first twenty years leading up to the start of the substantially deferred life annuity, keeps individuals in control of their money through that twenty year payout period and enables them to keep overall fees to a minimum.

CLMR Funds are not for everyone and in all circumstances; so the best way to see if a CLMR Stabilized Payout Fund, possibly combined with a substantially deferred single payment life annuity, is right for you, you should first consult your financial and tax advisor.